By Li Jin, Geoff Hamilton, Jesse Walden, Spencer Noon, Derek Walkush and Medha Kothari

Thirty years into the development of the world wide web, a handful of companies control most user attention and advertising revenue, with closed ecosystems that hold back innovation by independent developers. The economic interests of the biggest internet platforms are poorly aligned with their most valuable contributors: their users.

Ownership has long been embraced by Silicon Valley startups to align incentives among employees through option grants. Still, the vast majority of internet users own exactly 0% of the services they contribute to. Creators don’t own their content, developers can’t control their code, and consumers can’t influence the policies or decisions of the platforms they use. This scenario, which once went unquestioned, looks increasingly archaic.

This is starting to change via the ownership economy—often referred to as web3—with products and services that turn users into owners.

What started with Bitcoin and Ethereum—both of which reward participants who secure the network with their native tokens—is becoming prevalent across all categories of software, from developer infrastructure and new financial markets in DeFi to consumer products, marketplaces and social.

A new internet owned by users

If the last generation of software was built upon a foundation of user-generated content, the next generation of software will be user-owned, with digital ownership leveraged as a building block to enable novel user experiences. At its core, the ownership economy not only offers a powerful new tool for builders to leverage market incentives to jumpstart new networks—it also holds the potential to create positive social change through the wider distribution of wealth-building assets.

In the two years since Jesse Walden published the initial vision for a user-owned internet, the landscape has dramatically shifted and expanded. There are now more than 15,000 projects in the ownership economy, from user-owned financial markets to user-owned social networks, investment clubs, and digital assets. While the ownership economy still represents a small portion of all internet platforms, it’s a fast-growing segment. Ethereum, one of the more mature networks that supports the ownership economy, grew 46% in monthly average accounts in 2021.

Amidst all this growth, we wanted to take a step back and re-introduce this ecosystem through some fundamental questions: what is the ownership economy? How big is it, and where is it headed? What trends are defining its current state, and possible future? To answer all of these, we’ll turn to data and case studies that illustrate how the ownership economy is playing out in real time.

This report is meant as a primer for new entrants to web3 who are looking to go one level deeper. We’ll also be using it as a jumping-off point for more in-depth pieces that we’re planning to publish this year on topics like token distribution strategy, regulatory issues and more.

Without further ado, let’s jump in.

What is the ownership economy?

Simply put: the products and services that will define web3—and the next generation of the internet—are those that transform users into owners. We call this the ownership economy.

Still, identifying this phenomenon isn’t always simple, or obvious. That’s because ownership manifests across a spectrum of experiences that range in user effort, responsibility and degree of collectivity. One user might own a single digital media asset, like an NFT. Another might influence a network’s operation via a governance token. The experience of being an owner encompasses both passive (i.e., hodling) and active participation.

Note that for this report, we focus on crypto tokens—rather than equity—as the basis of the ownership economy. Tokens have a richer and more frictionless design space. They can be distributed programmatically, with the potential to reward participants versus those who buy in; they are effectively free to deploy, and they can transfer value in the same way we transfer information—instantly, to anyone, anywhere in the world.

The ownership economy is big—and growing

As of April 26th, 2022, the market capitalization of the over 19,000 tokens tracked by data aggregator CoinMarketCap is $1.76 trillion. For comparison, the market capitalization of global stock markets is over $100 trillion.

The largest cryptonetworks by market capitalization are established layer 1 blockchains: Bitcoin ($725 billion), which was launched in 2009, and Ethereum ($337 billion), which was launched in 2015. Other layer 1s in the top 20 tokens by market capitalization include Solana, Polkadot, Terra, and Avalanche.

We can also think about the scale of the ownership economy in terms of people—the users who become owners in the networks they build.

The Financial Times and Chainalysis estimated that there were 360,000 owners of NFTs as of 2021. Beyond that, there are tens of millions of users of cryptonetworks. Metamask, a wallet that is used to connect to decentralized applications, recently announced that it had 32 million monthly active users as of February 2022, and Phantom (a wallet currently focused on Solana) announced monthly active users of 2 million in January 2022. In the fourth quarter of 2021, Ethereum had monthly average transactional users of about 6 million and daily active transactional users of about 400,000. From a multi-chain perspective, there were approximately 2.5 million average daily active users interacting with the smart contracts tracked by DappRadar. As a rough approximation, if we extrapolate these 2.5 million daily users to calculate monthly users using Ethereum’s DAU/MAU ratio of 0.06, we could estimate MAU of 39 million across the 29 networks covered by DappRadar’s data.

DAOs, decentralized autonomous organizations, are online communities owned and governed by their members. They can be thought of as the organizational building blocks that make up web3’s economic, social, and cultural landscape. New DAOs are forming at such a rapid pace that it’s difficult to count them, but it seems safe to say there are over 1,000. DeepDAO, a data source, tracks detailed information about around 180 DAOs. In these DAOs alone, there are 1.7 million holders of governance tokens, and about 500,000 of these holders actively participate in DAO governance. And some of these DAOs are quite large: 69 of the 180 have more than 1,000 members.

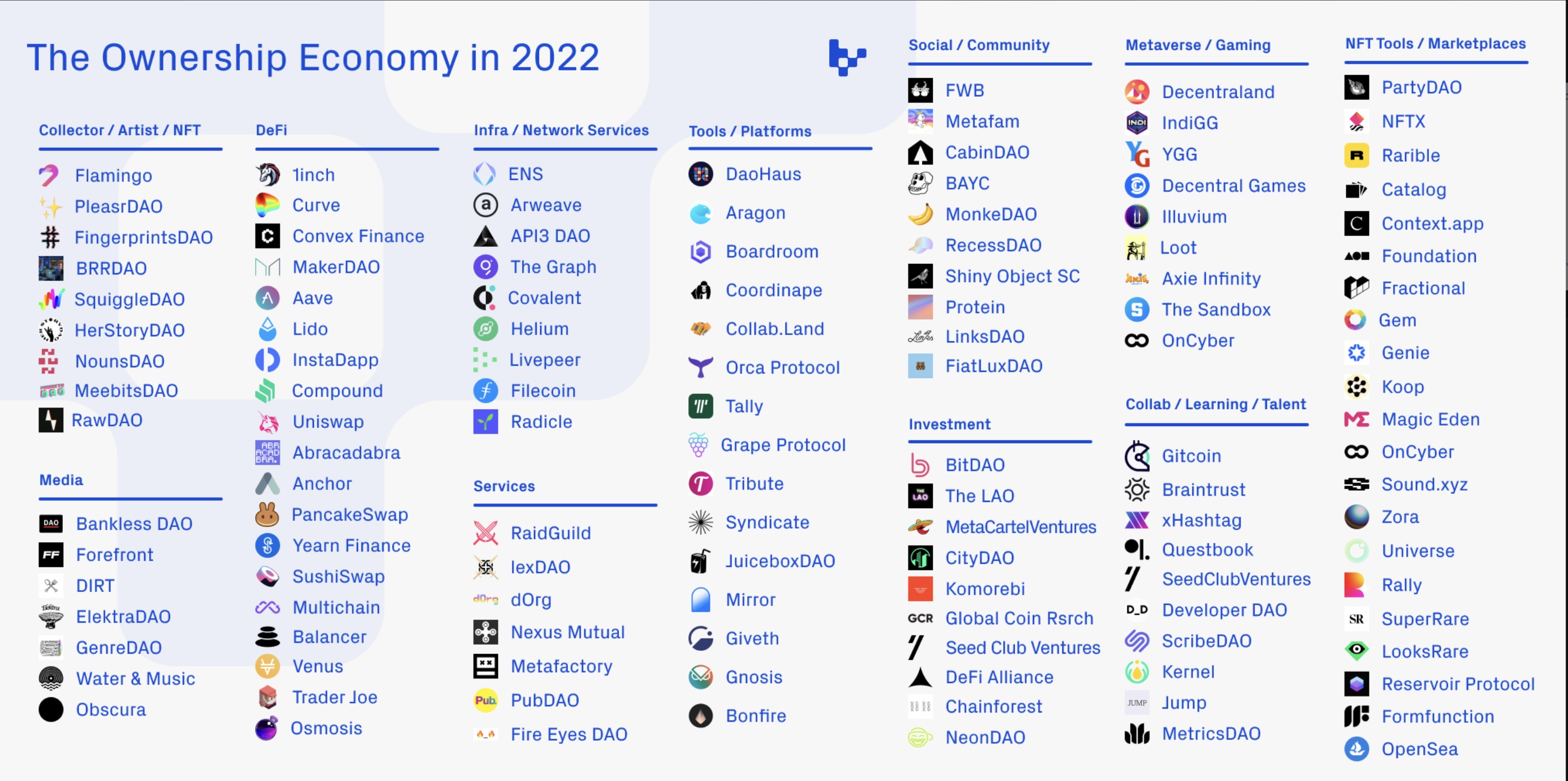

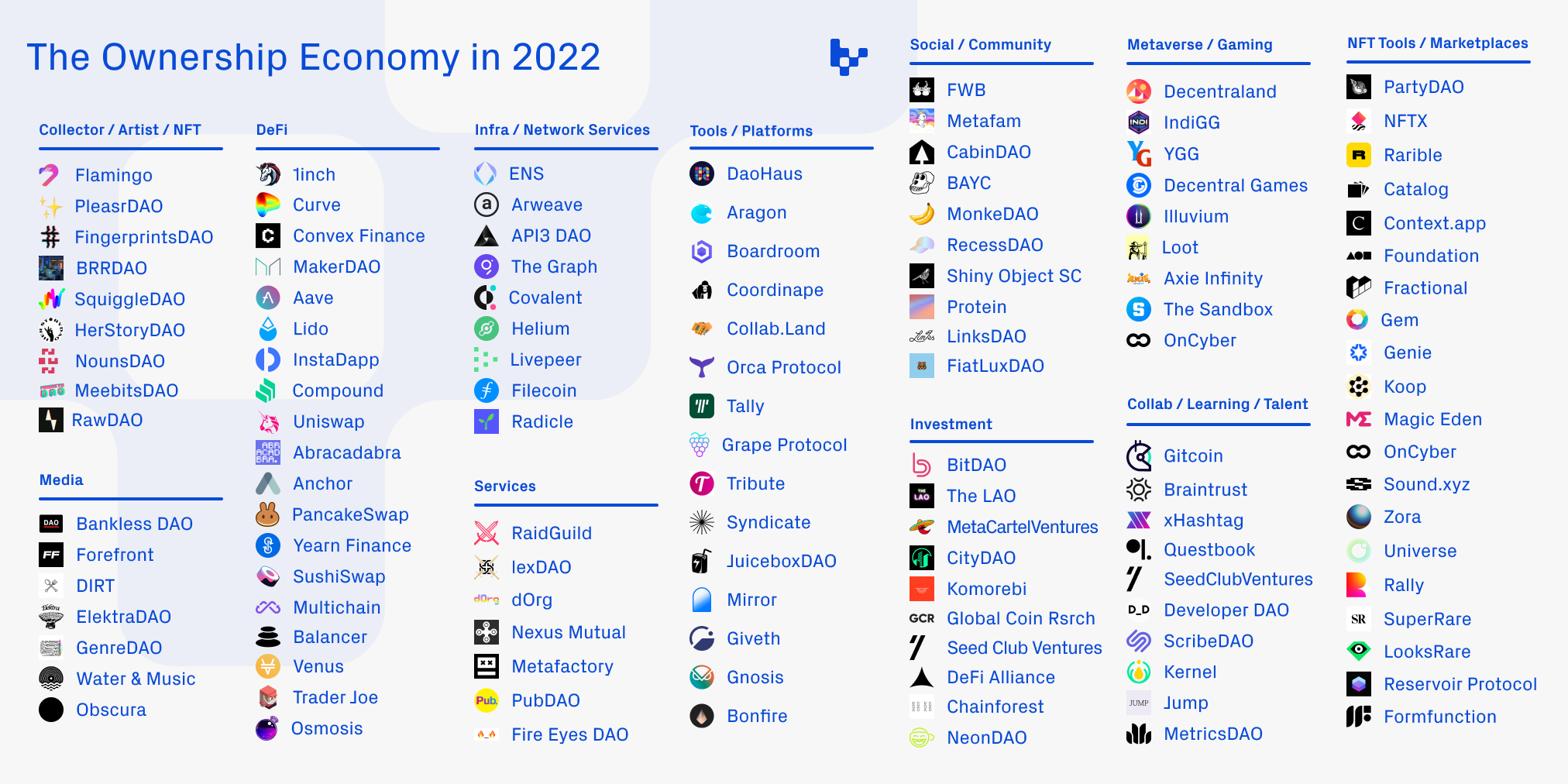

State of the ownership economy in 2022

Today, user ownership is transforming how people transact, invest, create, build, play, learn, communicate, and socialize.

Don't see your project on this map? Submit it here.

Walden’s original essay “The Ownership Economy” posited that user ownership could result in “platforms that can be larger, more resilient, and more innovative.” As we discuss throughout this report, many of these aspirations are not yet realized, or have mixed results, owing to nascent playbooks on how to best effectuate user ownership. Still, we remain confident in the power of user ownership to build bigger, more defensible networks and to catalyze positive social change. Realizing that potential requires additional research on best practices regarding ownership distribution and education geared towards developers and users. As a step towards that, we wanted to share a few key insights on the state of the ownership economy today.

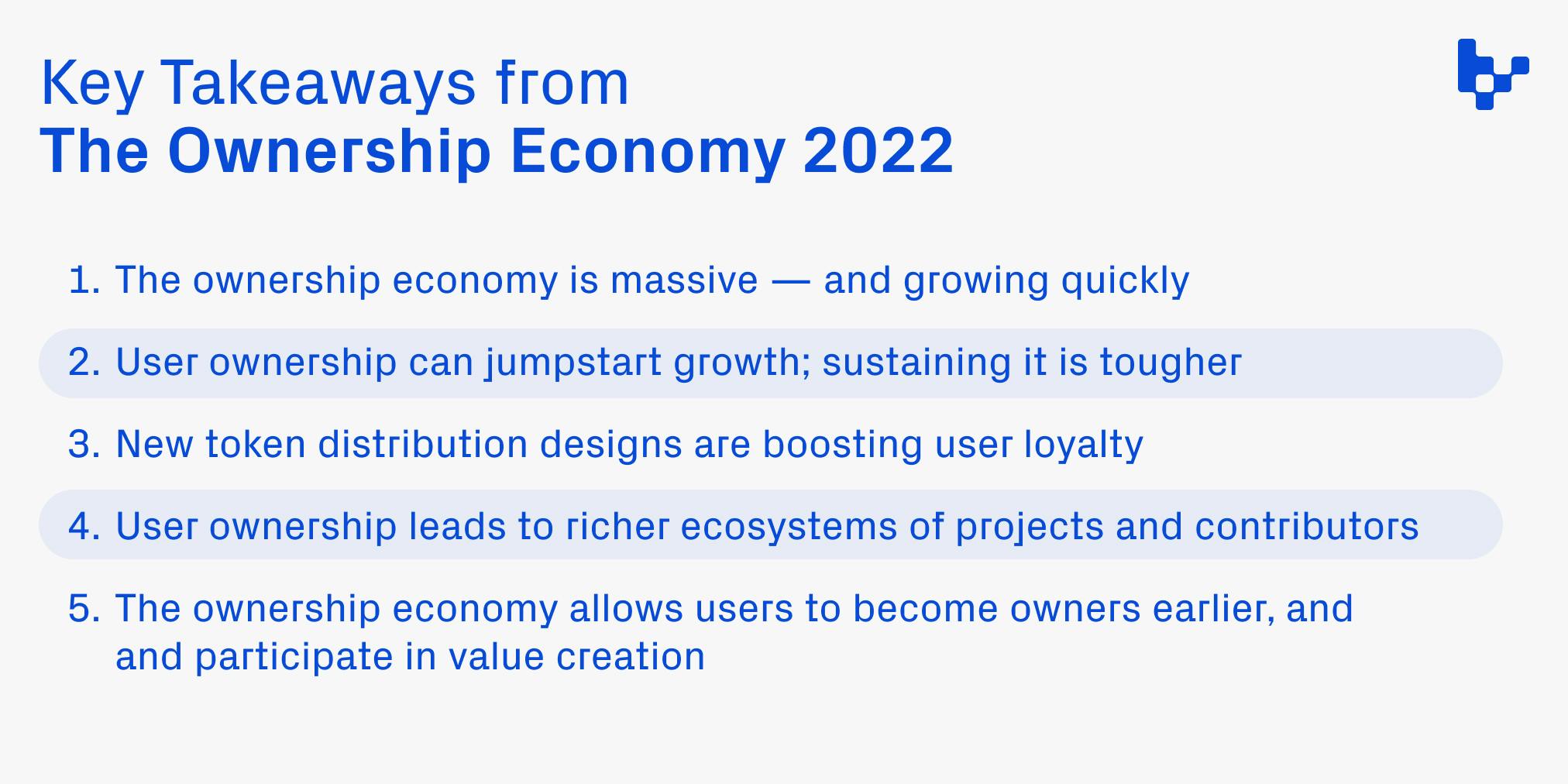

1. User ownership can jumpstart growth, but sustaining it is more challenging

Giving users ownership in the form of tokens can be a powerful alternative to paid marketing, helping to bootstrap networks and overcome the cold-start problem.

But before we dive into that, let’s consider how much it costs for non-crypto services and products to bring users on board. In 2015, Facebook's mobile app install advertising business reached $2.9 billion in revenue, comprising 17% of Facebook's total ad revenue. That’s a huge sum of money going into the pockets of an intermediary platform—Facebook—rather than flowing to app developers to invest in R&D and product improvements, or reaching the end users in the form of lower prices or greater rewards. The hefty upfront fees for user acquisition also means that consumer apps that are unable to raise outside capital are hard-pressed to get off the ground: the average cost to acquire an app user was $3.52 in 2019.

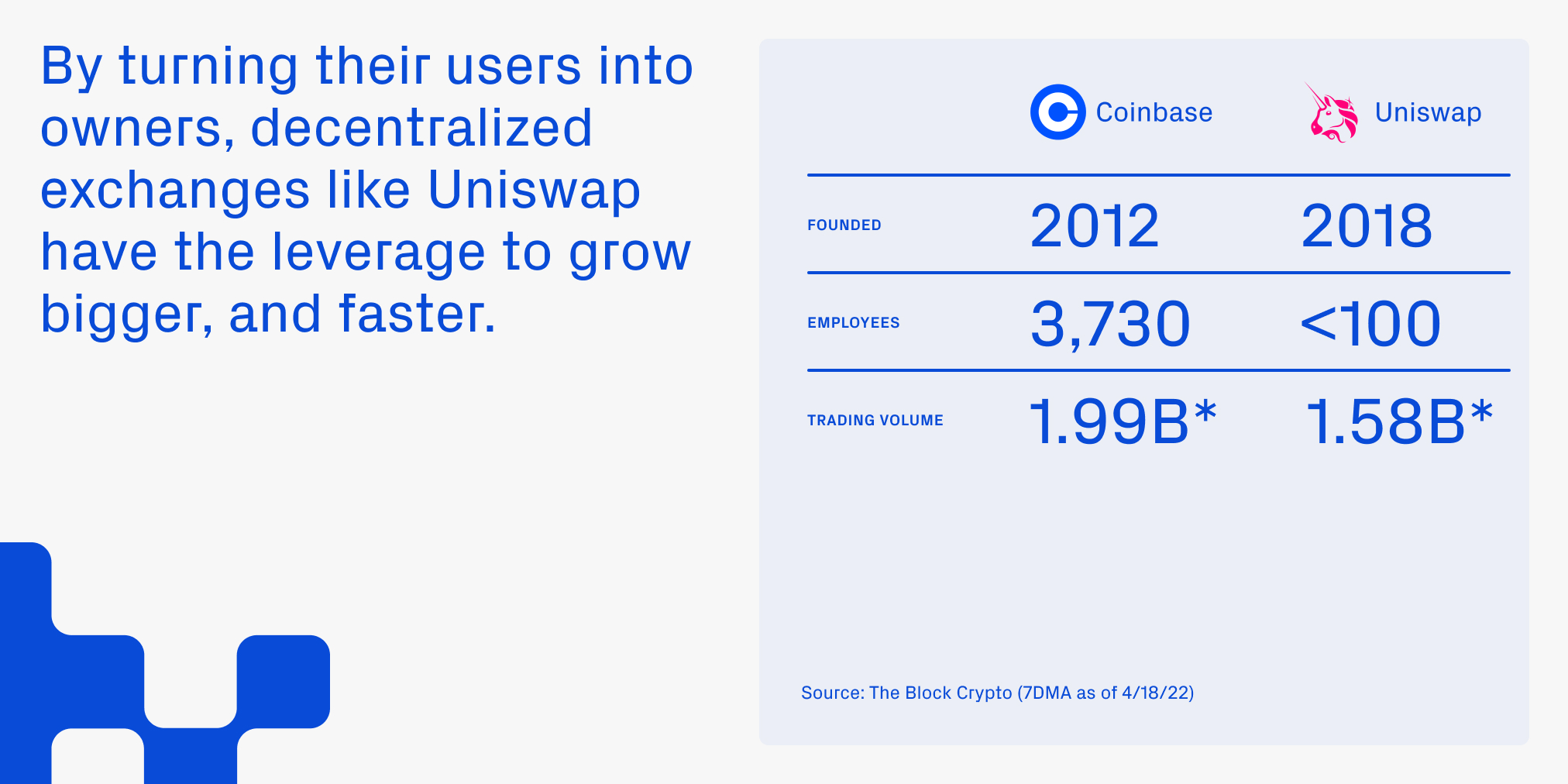

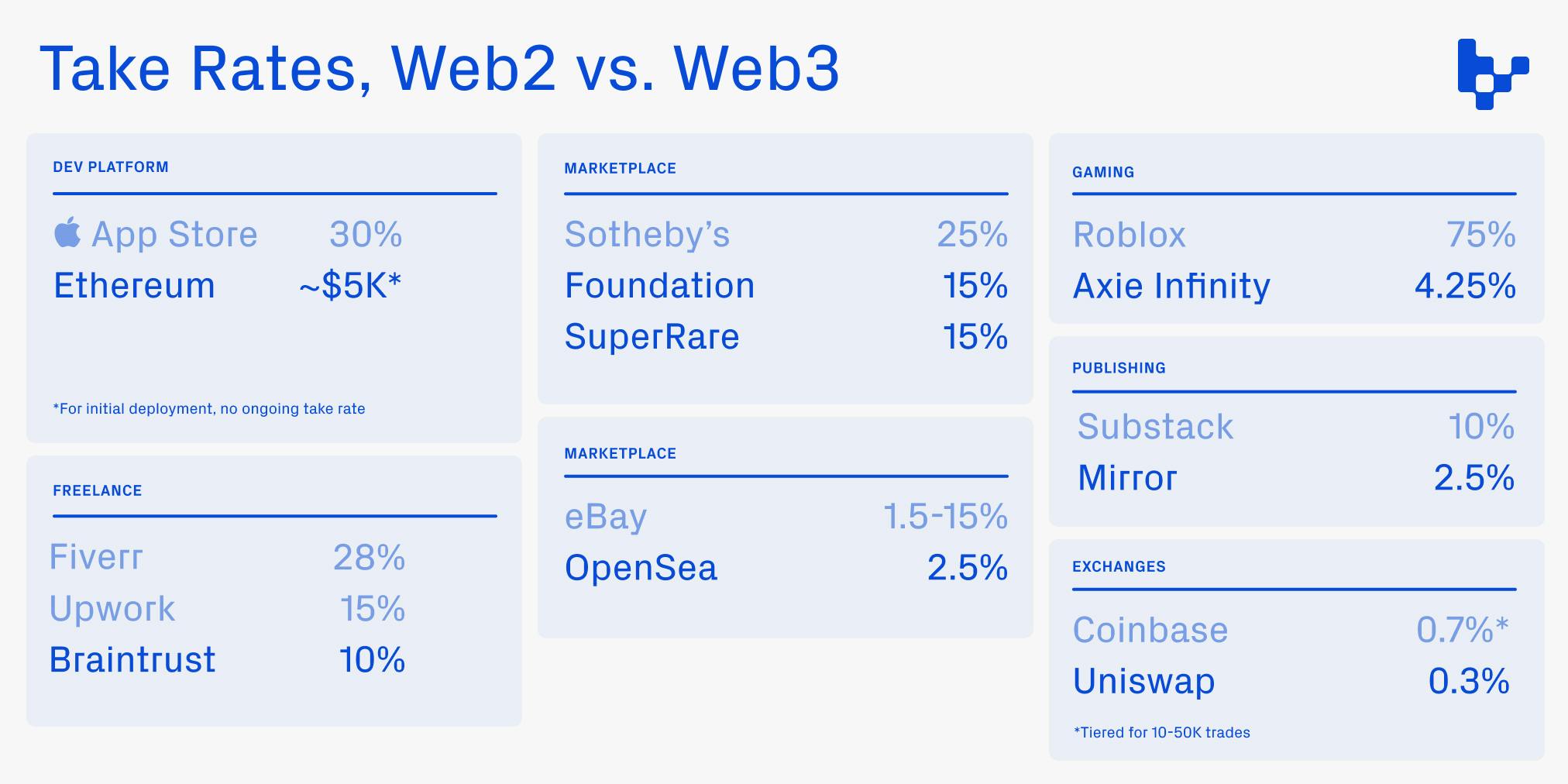

In contrast, for crypto projects, giving users ownership can function as marketing, drawing in new users through the promise of ownership and increasing engagement as a result of having skin in the game. A case study is Coinbase and Uniswap, two cryptocurrency exchanges that enable users to swap various tokens.

While Coinbase is a centralized exchange that custodies users’ wallets and funds and matches trades using its order book, Uniswap is decentralized and facilitates automated transactions entirely through smart contracts. Coinbase was founded in 2012, and employs 3,730 people as of 2021. In contrast, Uniswap was founded in 2018, and has less than 100 employees. With just 3% of the headcount of Coinbase, Uniswap does 73% of its trading volume. How is this possible? Importantly, Uniswap makes its users owners via governance tokens and LP shares, giving it leverage to grow bigger, faster. In addition, because Uniswap is decentralized, anyone can add any asset. If all the world’s value will be tokenized in the same way all information was packetized on the internet, then we should expect decentralized exchange growth to outpace their centralized counterparts.

Tokens aren’t a replacement for product-market fit

However, in our analysis, it is clear that simply giving users ownership is not sufficient to ensure that a product wins out over its competitors. Tokens can be useful in capturing user attention and bootstrapping initial adoption, but they need to be coupled with strong product-market fit—solving a widespread need for users—in order to sustain usage.

The NFT landscape is a prime example of the insufficiency of ownership to drive consistent, ongoing engagement. The dominant NFT marketplace, OpenSea, has over 90% market share of transactions despite not having a token, whereas multiple competitors do (e.g. LooksRare, SuperRare, Rarible). Notably, after Rarible launched liquidity mining—token airdrops to users who buy and sell NFTs on the Rarible marketplace—in summer 2020, its volume briefly surpassed that of Opensea, but Opensea’s deeper liquidity, stronger product, and better search features helped it to win out over time. For users of marketplaces, liquidity—the presence of a counterparty for one’s desired transaction—is still the strongest motivator to choose any marketplace over another. The existence of a token that incentivizes transactions in alternative smaller marketplaces is insufficient to overcome OpenSea’s advantage in meeting the core user need of transacting.

Another example is layer 1 blockchain ecosystems. Despite L1 blockchains all offering their own native token representing network ownership, Ethereum is still the fastest growing platform because of the network effects of users and developers, more mature developer tooling landscape, and ability to compose with other existing applications. Those factors indicate that even the lower fees of alternative blockchains are not sufficient to overcome Ethereum’s network effects (though whether it’ll maintain its advantage is unknown).

There is also the question of whether ownership actually crowds out intrinsic incentives to use a product, causing users to engage with products in a more mercenary, transactional (and likely temporary) way. There has been an abundance of research on the interplay of extrinsic motivations—behavior undertaken for some external reward like financial benefits—on intrinsic motivation. According to some studies, extrinsic motivations can undermine intrinsic motivation, especially when users previously found that behavior intrinsically rewarding. The implication is that token incentives should be optimized in terms of timing (via progressive decentralization), magnitude, eligibility, and other factors so as to preserve users’ intrinsic motivation.

2. New token distributions designs are boosting user loyalty

In theory, when users become owners and are (literally) invested, they should become more highly engaged and retained. Today, the reality is mixed.

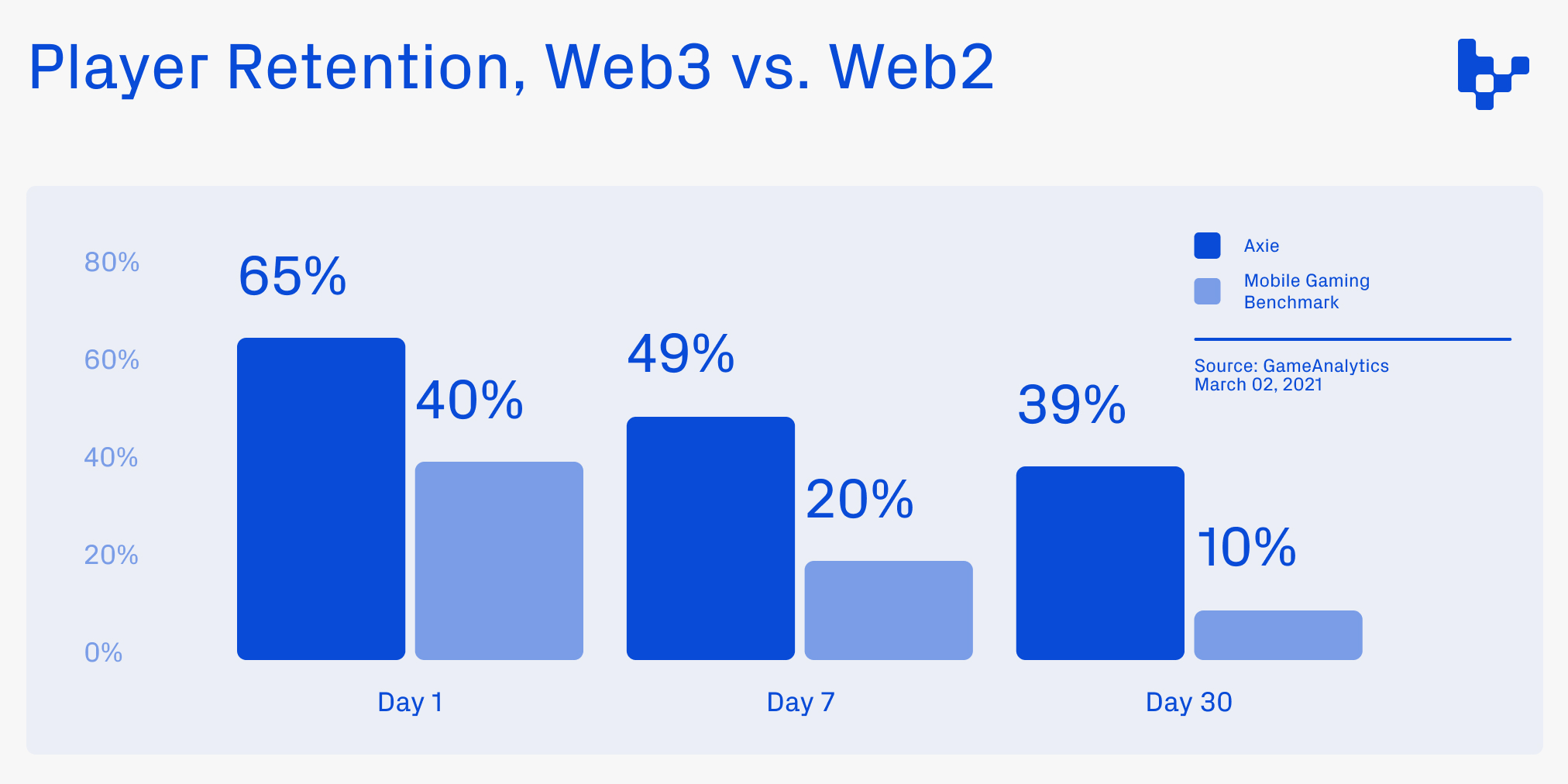

One powerful illustration of ownership engendering loyalty is the success of play-to-earn games like Axie Infinity. Axie Infinity is a blockchain-based game in which users collect, breed, and battle digital creatures called Axies, which are NFTs. The ownership of in-game assets is a key difference between blockchain games like Axie Infinity and non-blockchain games: in the latter, “owned” assets generally cannot be exchanged for money or transferred outside of the game.

Ownership of in-game assets can engender more player loyalty.

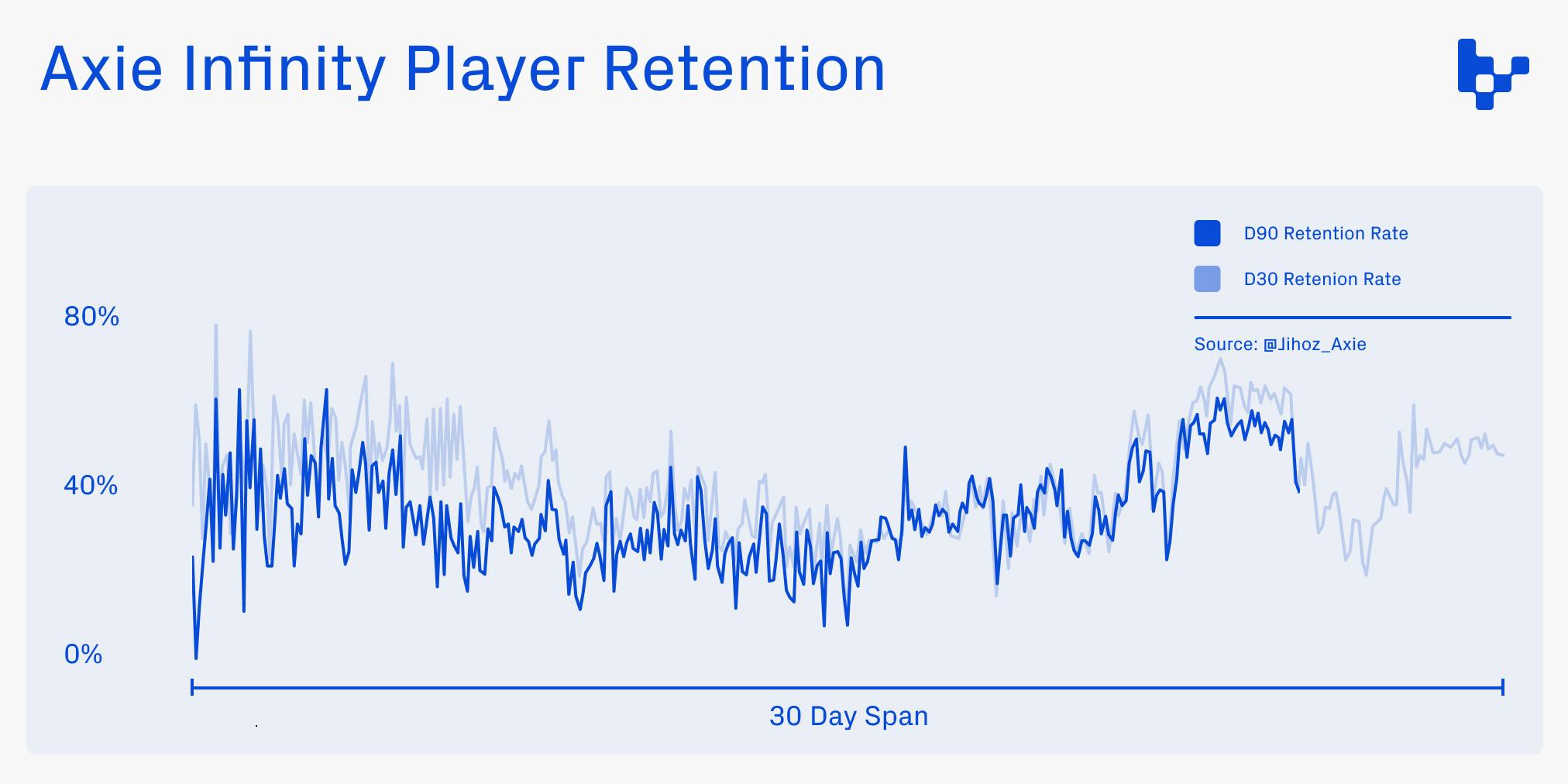

Powered by a play-to-earn mechanism in which players earn tokens in the game that can be exchanged for their local currency, Axie Infinity has achieved significant scale, with over $1 billion in cumulative revenue and nearly 3 million daily active users. And the game’s player retention is dramatically higher than that of traditional mobile games. Axie Infinity’s player retention has remained strong and consistent over time, suggesting that engagement is not simply a function of the game’s novelty.

Axie Infinity’s retention has remained strong over time compared to traditional mobile games, highlighting the importance of digital ownership.

But there are counterexamples of token incentives’ mixed impact on user engagement. The entire field of tokenomics is in its infancy, with best practices around ownership distribution still unknown. To date, users have raised important questions and made critiques around token incentives and the efficacy of ownership to translate into user loyalty or desirable societal outcomes.

While liquidity mining programs (rewarding users with ownership via tokens for providing liquidity) have become pervasive and driven short-term participation in new products, they have not historically contributed to long-term sustainability. According to research from Nansen, "A whopping 42% of yield farmers that enter a farm on the day it launches exit within 24 hours. Around 16% leave within 48 hours, and by the third day, 70% of these users would have withdrawn from the contract." The extrinsic nature of token incentives means that many liquidity providers are financially motivated by the highest rewards, leading to churn.

Furthermore, while almost impossibly high token incentives became a defining feature of the “DeFi 2.0” wave, their sustainability is now in question. Changing market sentiment led to dramatic price crashes for many of these projects, and their tokenemonic models became the subject of serious debate. These downturns most acutely impacted contributors paid in a project’s native token—often subject to vesting schedules—and the project’s most passionate supporters.

Innovations in token distribution

As a result, many projects are rethinking token incentive mechanisms, and a wave of new models is beginning to emerge. For example, Curve’s voting escrow (“ve”) contracts use lockup periods to increase token rewards; Gro also introduced a vesting mechanism to encourage long-term engagement. As scholarship about token engineering and cryptoeconomics proliferates, these models are increasingly tested and scrutinized, suggesting the next generation of tokens will more effectively engage users and incentivize long-term contributions.

At a high level, the opportunity is to make token distribution more granular and targeted in rewarding behaviors that actually contribute to a network’s retention and sustainability, versus simply rewarding users whose tech-savvy networks translate into early knowledge of new products or who engage in mercenary behavior. Such distribution would result in more accessibility than first-generation projects that priced out later users, and be orders of magnitude better than compounding returns to capital that exist in the real world, where capital needs to be bought rather than earned. As an example, the token-gated social community Friends with Benefits (FWB) requires 75 FWB tokens to join, which at one point was equivalent to over $12,000. But beyond buying the tokens, there are ways to join the community through earning ownership, including writing, designing, creating artwork through FWB’s studio, or contributing to various work streams.

Beyond direct contributor rewards, some DAOs began implementing bounty programs to attract users and delegate work. These one-off tasks range from short-term developer assistance and business development to simple community participation, with payouts in the project’s native token. Platforms such as Rabbithole and Layer3 aggregate these bounties for multiple DAOs, giving potential users the opportunity to search for both projects and tasks that fit their interests. A new generation of token incentives seems to be placing greater emphasis on contributor growth compared to solely deepening liquidity—an imperative transition to grow the ownership economy’s user base.

3. User ownership can foster richer ecosystems of projects and contributors

When they combine distribution of ownership with permissionless access, user-owned projects can foster rich ecosystems. Deployed in this way, distributed ownership can be a catalyst for projects to become platforms that third-parties build on.

Ethereum is one of the most powerful illustrations of this. The distributed ownership of the network has fostered a community of developers and users with an interest in the continued success of Ethereum: the value of their stake in Ethereum—their Ether—supplies ample incentive to continue building on and using the network, engendering an ecosystem of applications across social, marketplaces, DeFi, and more. Shared ownership reinforces network effects and creates a disincentive to switching to other blockchains. Of course, Ethereum’s success is not only a consequence of distributed ownership; it has also benefited from capable leadership and from embedding values that have helped align and motivate its community.

In the NFT space, another manifestation of decentralized ownership is emerging in the form of CC0 (or “no copyright reserved”) projects—those that relinquish all copyright and turn over their work to the public domain. Nouns, Cryptoadz, Chain Runners, and Loot have placed their assets in the public domain, allowing their intellectual property (IP) to be freely used, remixed, and commercialized.

As a result of their permissionless nature, users, creators, and developers have been attracted to these projects and have begun building around and on top of them. Loot is a CC0 NFT collection that exploded in popularity in September 2021, with each NFT containing a simple list of fantasy adventure gear. There are now more than 53 Loot derivatives and at least nine guilds—groups for owners of specific items in the Loot universe.

CC0 NFT projects create the potential for their IP to be used in novel and generative ways—increasing the reach, relevance, and, ultimately, the value, of that IP. 4156, a contributor to Nouns DAO, said: “In the same way that academic citations make the original paper more important, citation of Nouns in whatever form … will make the originals more important and more valuable.” Nouns is putting this theory into practice by catalyzing the proliferation of its IP and pursuing collaborations with other brands (like Bud Light, which incorporated the iconic Nouns glasses in a Super Bowl commercial) and traditional media companies.

Similarly, the team behind Cryptoadz collaborated with Arcade NFT, an art and gaming studio, to produce Toad Runnerz, an NFT collection in which each NFT is a playable arcade-style game that incorporates Cryptoadz as in-game assets. Arcade NFT hosts exclusive tournaments for Toad Runnerz NFT holders, further extending the reach and content of the underlying Cryptoadz IP into the gaming space.

By enabling free use of their assets, CC0 NFT projects extend the definition and possibilities of ownership. This approach has the capacity to stimulate building, creation, and collaboration—and we’ve only just begun to see its potential.

4. The ownership economy allows users to become owners earlier and participate in value creation

A key theme of the ownership economy is that users become owners faster than in their centralized counterparts, allowing them to contribute to and benefit from value creation.

In our analysis, we found that on average, web3 companies that launched a token did so 2.7 years after founding; in 2020, VC-backed companies went public approximately 5.3 years after securing their first VC investment. The timeline of IPOs, compared to token launches, serves to eliminate a significant amount of upside potential for retail investors.

This phenomenon comes into sharp focus when comparing Coinbase and Uniswap. Coinbase went public in April 2021, nearly nine years after the company was founded. The stock ended its first day of trading with a market capitalization of $85.7 billion, an incredible outcome for private investors such as Y Combinator, which seeded the company in 2012 at a valuation of roughly $2 million.

However, Coinbase’s public listing did not represent a great outcome for retail investors, whose opportunity to invest only came after the company’s valuation had multiplied 40,809x from its first private investment round. In fact, every retail investor who purchased and held Coinbase stock since its public listing has lost money on their investment, as of April 2022.

In the ownership economy, by contrast, projects exit to their communities much earlier in their lifecycles, allowing users to contribute to and benefit from greater value creation. Uniswap launched its UNI governance token in September 2020, less than two years after the protocol was originally deployed onto the Ethereum mainnet. Unlike Coinbase, whose direct listing meant no new shares were issued when it went public, 60% of the UNI genesis supply was allocated to Uniswap users. This profile is commonly seen with projects in the ownership economy.

The future of the ownership economy

The playbook is still being written, but one thing is certain: ownership is becoming a keystone of new experiences across all categories of software products. Web3 started as a developer phenomenon with layer 1 blockchains, and most innovation has historically been developer-facing initially. But Chris Dixon predicted with his adage—“what the smartest people do on weekends is what everyone else will do during the week in ten years”—ownership is now extending to all kinds of products and networks.

We are eager to work with builders who are applying new models of ownership to design a more meritocratic internet. If you are working on a project in this space, please reach out.

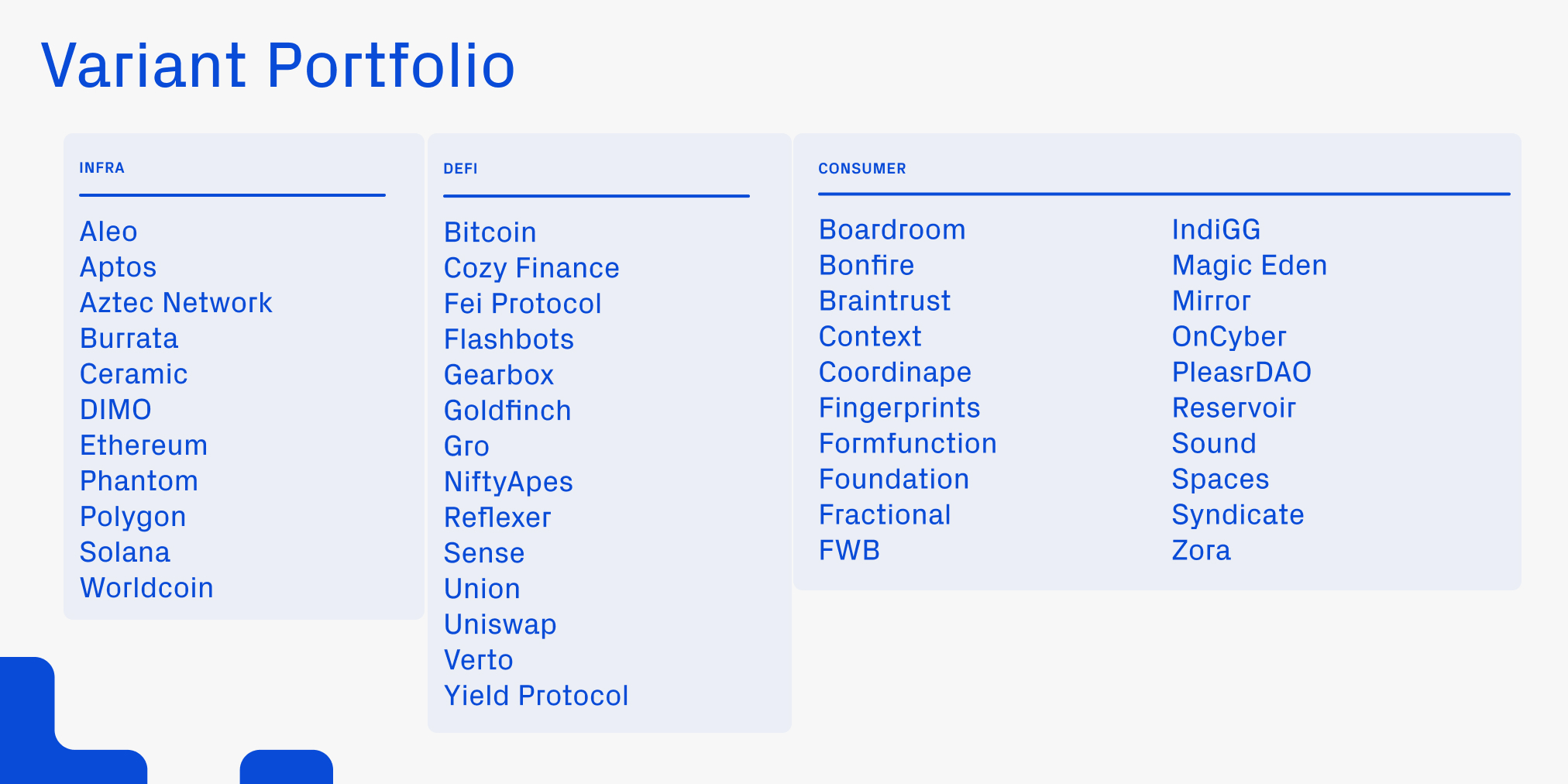

To learn more about some of the projects that comprise the ownership economy and Variant’s growing portfolio, see below.

***

This report is the result of input and contributions from many people. Variant would especially like to thank Chuxin Huang, Kate Lee and Caleb Halter. In addition, many others contributed both data and advice: Mohammed Nasirifar from Chaincrunch, Rob Hoogendoorn from DappRadar, Adam Whitaker-Wilson from Covalent, @ruvaag, Adam Delehanty and Mason Nystrom.

If you’re interested in working in web3, check out the Variant Talent Network to find opportunities at our portfolio companies, or openings at Variant Fund.